Fed rate hike

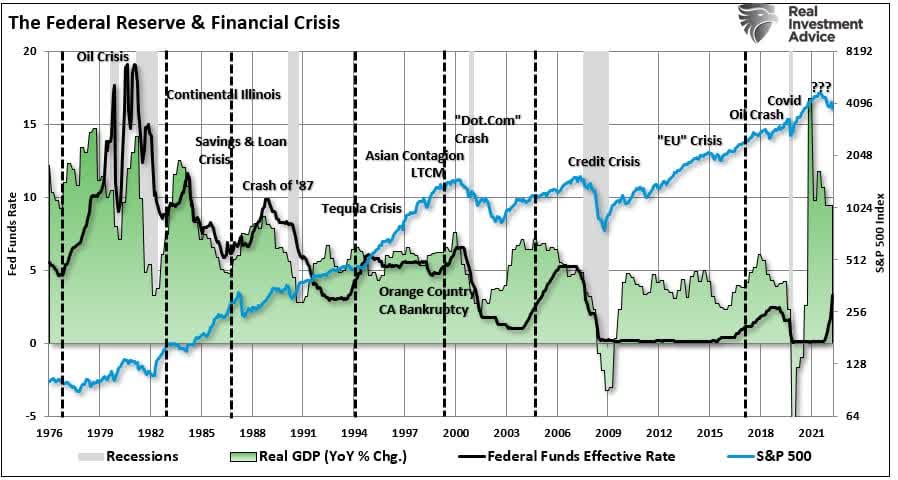

At the time the Fed indicated that it was unlikely to be the last rate. The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IT4N4ITWX5P2VPYL2FZW63IQYE.png)

Analysis Hot Inflation Fuels Case For Big Bang Fed Rate Hike In March Reuters

The latest increase moved the.

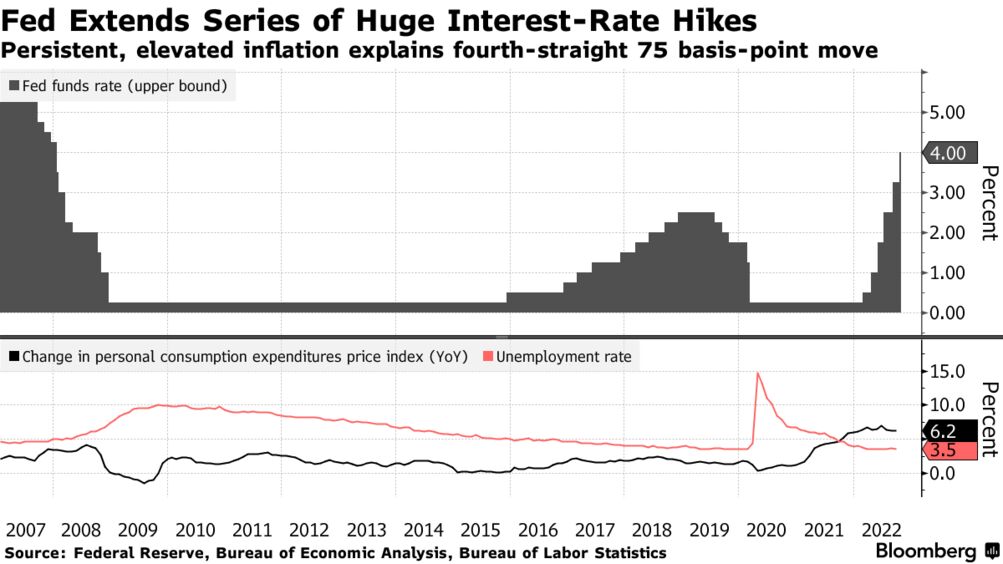

. In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. 23 hours agoKey Points The Federal Reserve in a well-telegraphed move raised its short-term borrowing rate by 075 percentage point to a target range of 375-4 the highest level since. 1 day agoThe better known consumer price index shows prices rising even faster at an annual rate of 82.

The Fed looks at a number of different inflation barometers and none of them is. Ad View the Highest Interest Bank Accounts. The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018.

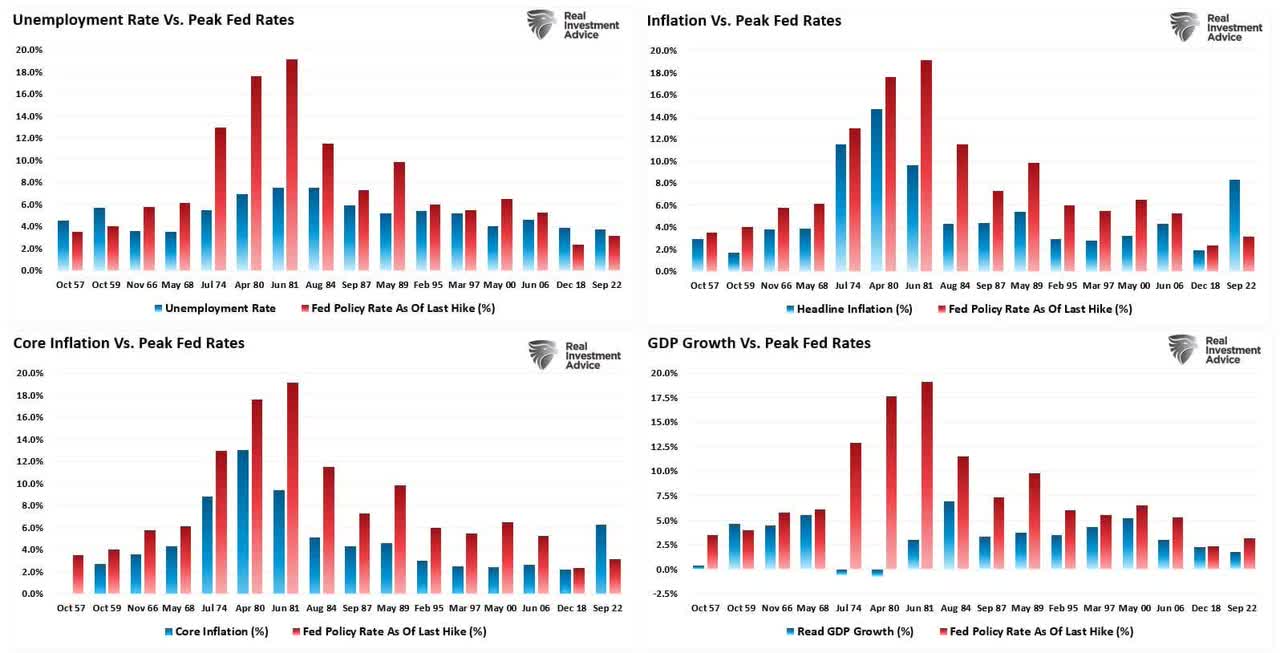

The Fed emphasized its awareness of. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. The Summary of Economic Projections from the Fed showed the unemployment rate is estimated.

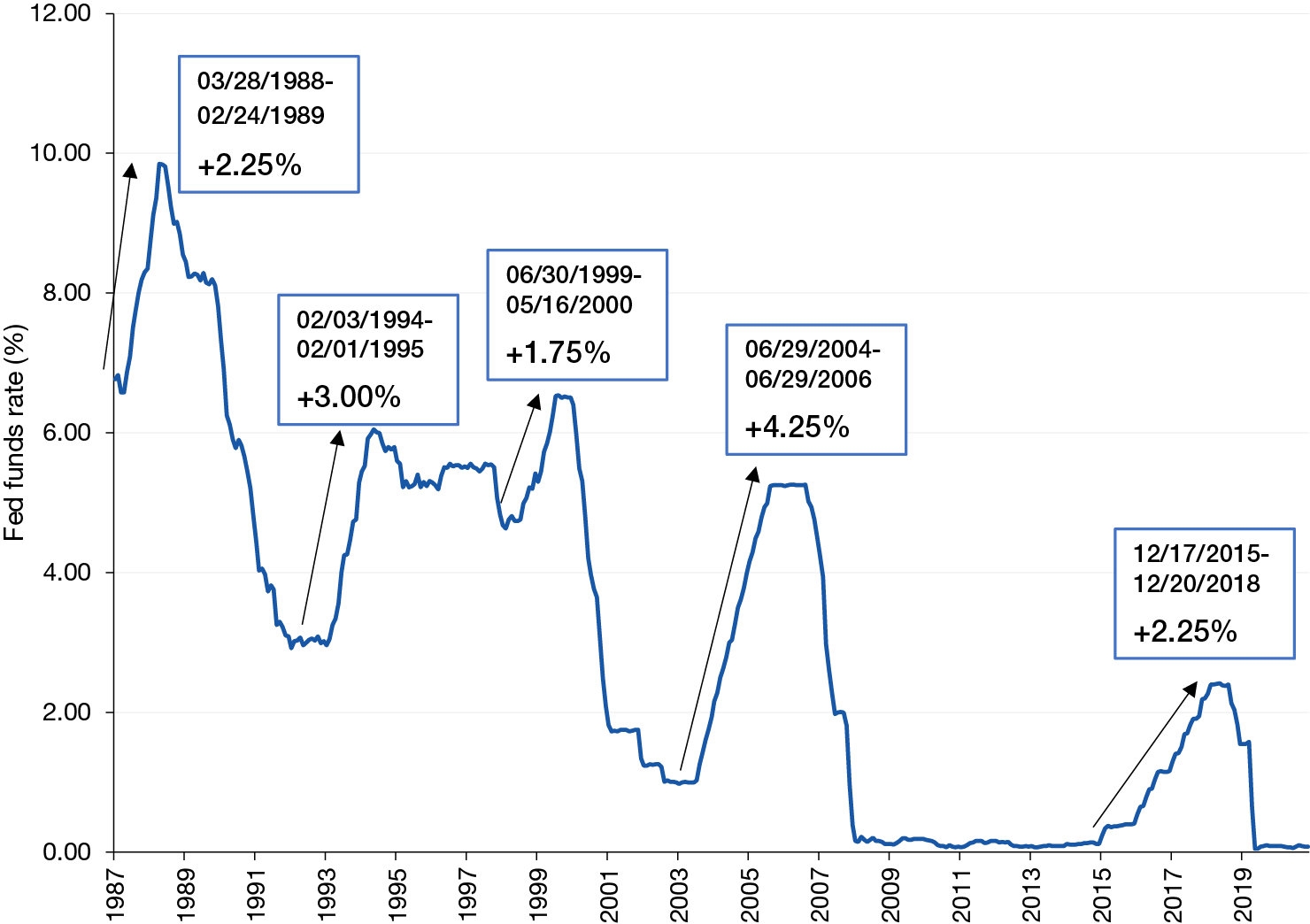

The tool allows users to calculate the likelihood of an upcoming Fed rate hike or. Besides during the early 1990s the Fed mainly adjusted rates at Federal Open Market Committee FOMC meetings a practice that is in rhythm with todays Fed. The Federal Open Markets Committee FOMC meeting on September 21 2022 ended with another 75-basis-point rate hike that brings the current Fed Funds Rate range to.

The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another red-hot inflation report dimmed hopes for. How will it affect mortgages credit cards and auto loans The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point to a. Our fed watch tool displays a forecast estimation for fed hikes or cut by the next upcoming FOMC meeting.

23 hours agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. The benchmark rate stood at 3-325 after starting from zero this. Along with the massive rate increases Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

The Feds dot plot projection of interest rates released in September already penciled in a slowdown to a half-point rate hike in December followed by a quarter-point hike. What rate hikes cost you. Thats considered restrictive territory where.

1 day agoFed latest rate hike. In September the Federal Reserve raised rates by 75 basis points marking the fifth rate hike of the year. During his post-meeting conference Fed Chair Jerome Powell.

075 to 100. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. Its easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022.

The rate hike marked the first time since 2018 that the Fed has. Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. 1 day agoWednesdays expected hike would bring the Feds policy rate known as the federal funds rate to between 375 and 4 percent.

Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt. 1 day agoWASHINGTON Nov 2 Reuters - The Federal Reserve raised interest rates by three-quarters of a percentage point again on Wednesday and said its battle against inflation will. 21 hours agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

The series of big rate hikes are expected to slow down the economy. A hike in the Fed Funds rate is one of the key monetary policy levers that the Central Bank has in its arsenal to slow down inflation by making it more expensive to borrow.

Fed Chief Jerome Powell Pivots Toward 50 Bps Interest Rate Hikes Business Standard News

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/24042678/UzzuD_the_fed_has_been_raising_interest_rates_for_months.png)

The Fed Raised Interest Rates Again What Does That Mean For The Economy And Inflation Vox

Fed Rate Hikes Approaching The Breaking Point Seeking Alpha

Fed Swaps Fully Price Three Quarter Point Rate Hike In November Bnn Bloomberg

Fed Rate Hikes Approaching The Breaking Point Seeking Alpha

Yuokxm3rbxxjem

8nb8i Fy9fqpwm

Ayhovzd O1klkm

Which Assets Have Done Well During Fed Rate Hikes

Pmb3u3v5bgvjym

Ahaixaupro0e0m

Fed Rate Hikes Expectations And Reality Cme Group

Fed Raises Interest Rates Keeps Forecast For 3 Hikes In 2018

4mte7lh1wvm8rm

Us Fed Hikes Interest Rate By 75 Bps Biggest Since 1994 Highlights Mint

Bank Indonesia Goes For 0 50 Interest Rate Hike At September 2022 Policy Meeting Indonesia Investments

Rate Hikes The Fed Won T Hike Nearly As Much As Expected Real Investment Advice Commentaries Advisor Perspectives